Beating poverty in a small way

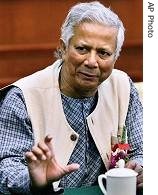

Nobel peace laureate Muhammad Yunus says he believes credit should be considered a human right. He says money is power. The economist believes poverty would end if the world could create a system of credit for poor people.

The message of Nobel peace laureate Muhammad Yunus ought to resonate deeply in this nation of strivers. Most Americans believe they just need a chance to climb the ladder of success.

Yunus invented the now-thriving industry of micro-lending 32 years ago by giving a chance to 42 female bamboo stool weavers in Bangladesh. He lent them the equivalent of $27. From that act came the bank he founded, Grameen Bank. It has since lent $5.7 billion to 6.6 million people and fostered myriad imitators around the world.

The idea was simple: Poor people have no money. Banks won't lend to them because they have no collateral. But given the chance, poor people could be just as creditworthy as the rich. Grameen, which means "village" or "rural" in Bengali, requires no collateral. It relies on peer pressure. The bank lends to small groups of poor people, each of whom is responsible for the debt.

Don't think this applies only to Third World countries. Yunus has advocated micro-lending to help Katrina victims. Give them a hand up, not a handout, he wrote. That's an American-sounding notion, courtesy of Bangladesh.

Read the Chicago Tribune story here.

1 Comments:

Good-girl-turned-bad Britney Spears has topped an eclectic list of the net’s most popular searches

n the run-up to Christmas. The popstar,who hit the headlines last week for stepping out

“commando” with her new best friend Paris Hilton,has helped revealed exactly what the internet

savvy are looking for from their stars - the thick and the dead.

Post a Comment

<< Home